Analysis of Latest Tungsten Market from Chinatungsten Online

On Monday, tungsten prices remained on an upward trend, with the overall surge showing no signs of abating. Upstream sectors led the charge, with tungsten mines enjoying healthy cash flow, and the supply gap continued to fuel speculative buying. Downstream sectors faced a dilemma, with powder metallurgy companies finding it difficult to pass on costs, leading to increased capital tied up in inventory. Under the pressure of supply-demand mismatch in the tungsten market, actual transactions were scarce, and the risk of high prices continued to accumulate. At the beginning of the month, industry players awaited new price guidance from institutions and tungsten companies.

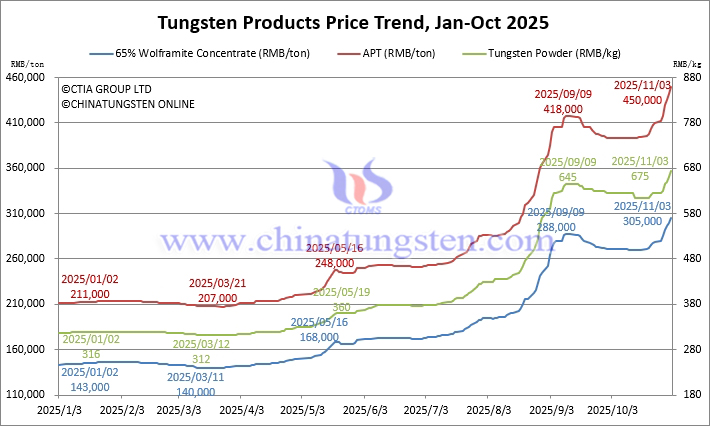

Tungsten concentrate prices continued to rise, constantly exceeding market expectations. Miners were not in a hurry to cash out, and the market remained firm.

65% wolframite concentrate was priced at RMB 305,000/ton, up 113.3% from the beginning of the year.

65% scheelite concentrate was priced at RMB 304,000/ton, up 114.1% from the beginning of the year.

Ammonium paratungstate (APT) prices also rose sharply. Upstream raw material replenishment was difficult, leading smelters to be cautious in accepting orders, focusing on maintaining existing customers.

Domestic APT prices are reported at RMB 450,000/ton, up 113.3% from the beginning of the year.

European APT prices are reported at USD 610-685/mtu (equivalent to RMB 384,000-431,000/ton), up 96.2% from the beginning of the year.

Tungsten powder prices have soared, but downstream finished product prices have fluctuated relatively little, hindering market cost transmission and resulting in cautious trading, with transactions negotiated on a case-by-case basis.

Tungsten powder prices are reported at RMB 675/kg, up 113.6% from the beginning of the year.

Tungsten carbide powder prices are reported at RMB 660/kg, up 112.2% from the beginning of the year.

Cobalt powder prices are reported at RMB 500/kg, up 194.1% from the beginning of the year.

Ferrotungsten prices have followed suit, mainly adjusting to fluctuations in tungsten raw material prices, with downstream demand passively following suit.

70% ferrotungsten prices are reported at RMB 410,000/ton, up 90.7% from the beginning of the year.

European ferrotungsten prices are reported at USD 90-93.5/kg W (equivalent to RMB 448,000-466,000/ton), up 108.5% from the beginning of the year.

Tungsten waste and scrap prices remain high with a wait-and-see attitude. Market risk appetite has clearly subsided, and more buyers are taking profits, leading to a further release of supply and increased bargaining power among buyers.

Scrap tungsten rod prices are reported at RMB 455/kg, up 106.8% from the beginning of the year.

Scrap tungsten drill bits prices are reported at RMB 428/kg, up 88.6% from the beginning of the year.

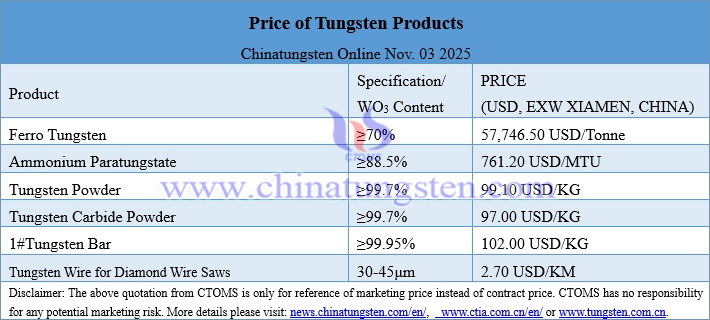

Prices of Tungsten Products on November 3, 2025

Tungsten Price Trend from January to November 3, 2025