Analysis of Latest Tungsten Market from Chinatungsten Online

Tungsten prices continue their rapid upward momentum, driven primarily by market sentiment, but actual transactions are lacking. A new round of price increases for long-term contracts by tungsten producers reflects the current robust market atmosphere and further boosts traders' confidence in quoting prices.

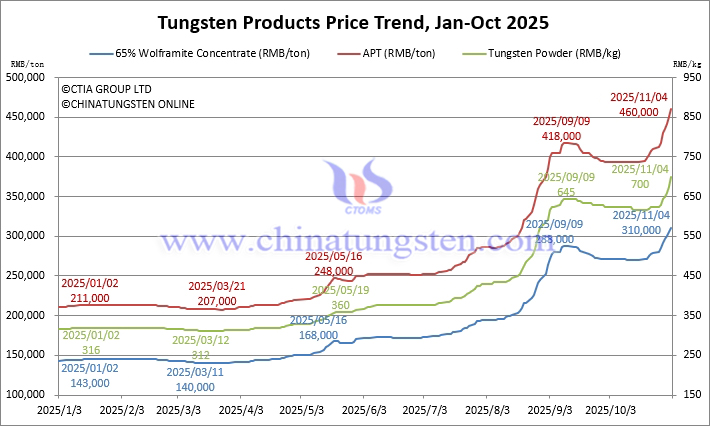

As of press time, tungsten concentrate prices have soared to a high of RMB 310,000/ton, APT prices have reached RMB 460,000/ton, and tungsten powder prices have broken through the RMB 700,000/ton mark!

The tungsten concentrate market is experiencing tight supply and rising prices, continuously breaking through key price levels. Current mainstream quotes have reached RMB 310,000/ton, a level close to the tungsten powder prices at the beginning of the year.

65% wolframite concentrate is priced at RMB 310,000/ton, up 116.8% from the beginning of the year.

65% scheelite concentrate is priced at RMB 309,000/ton, up 117.6% from the beginning of the year.

The ammonium paratungstate (APT) market is seeing a decline in volume but an increase in price, with the psychological price reaching above RMB 460,000/ton. The market is experiencing weak supply and demand, and tightening liquidity.

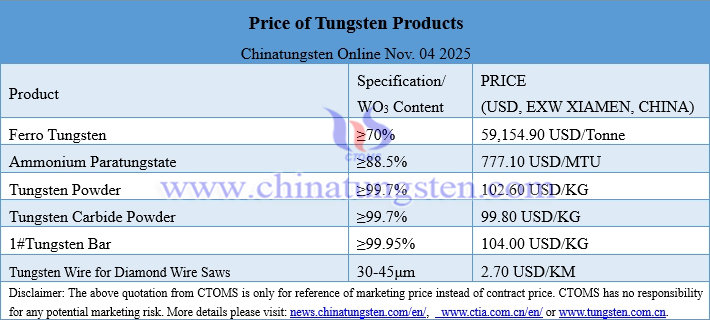

Domestic APT prices are RMB 460,000/ton, up 118% from the beginning of the year. European APT prices are reported at USD 610-685/mtu (equivalent to RMB 384,000-431,000/ton), up 96.2% from the beginning of the year.

The tungsten powder market is clearly following the upward trend, but due to increased difficulty in securing raw material supplies, traders are generally not proactively quoting prices, and are negotiating on a case-by-case basis.

Tungsten powder prices are reported at RMB 700/kg, up 121.5% from the beginning of the year.

Tungsten carbide powder prices are reported at RMB 680/kg, up 118.7% from the beginning of the year.

Cobalt powder prices are reported at RMB 500/kg, up 194.1% from the beginning of the year.

The ferrotungsten market is rising along with the market, with prices significantly strengthening due to cost-driven factors.

70% ferrotungsten prices are reported at RMB 420,000/ton, up 95.4% from the beginning of the year.

European ferrotungsten prices are reported at USD 90-93.5/kg W (equivalent to RMB 448,000-466,000/ton), up 108.5% from the beginning of the year.

Market sentiment in the tungsten waste and scrap market is polarized. Some holders are choosing to lock in profits, while others remain bullish and are delaying shipments. A wait-and-see attitude prevails, leading to fluctuating prices.

The price of scrap tungsten rods is reported at RMB 465/kg, up 111.4% from the beginning of the year.

The price of scrap tungsten drill bits is reported at RMB 435/kg, up 90.8% from the beginning of the year.

Prices of Tungsten Products on November 4, 2025

Tungsten Price Trend from January to November 4, 2025