Analysis of Latest Tungsten Market from Chinatungsten Online

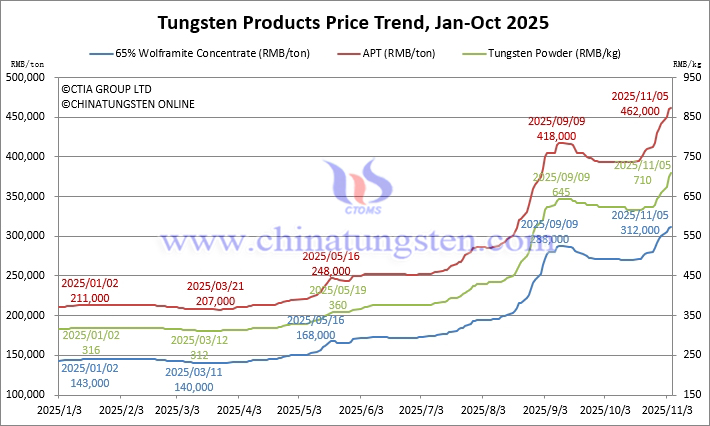

The tungsten price trend remains strong, though the increase has narrowed. The current market is extremely sensitive, with traders quite conflicted, exhibiting both a willingness to cash out and a mindset to chase highs. The industry is generally focused on pricing guidance from industry institutions and mainstream tungsten enterprises in the Jiangxi region.

The tungsten ore market continues to face a tight supply pattern. As annual mining quotas have not yet been clearly issued, miners maintain a strong reluctance to sell and a firm stance on pricing. The ammonium paratungstate (APT) and tungsten powder markets follow the ore end, showing tight supply and rising prices. Manufacturers primarily focus on maintaining relationships with existing customers and fulfilling prior orders, with sporadic order transactions being relatively rare. The cemented carbide market is operating under pressure, with poor cost transmission to the end-user, and tightened liquidity further suppressing market trading activity. In the tungsten waste and scrap market, more sellers are cashing in at high prices, but buyers' enthusiasm for taking delivery is lacking, leading to divided market confidence and a stalemate in the market.

As of press time,

the price of 65% wolframite concentrate is RMB 312,000/ton, up 118.2% from the beginning of the year.

The price of 65% scheelite concentrate is reported at RMB 311,000/ton, up 119% from the beginning of the year.

Domestic APT price is reported at RMB 462,000/ton, up 119% from the beginning of the year.

European APT price is reported at USD 610-685/mtu (equivalent to RMB 384,000-431,000/ton), up 96.2% from the beginning of the year.

Tungsten powder price is reported at RMB 710/kg, up 124.7% from the beginning of the year.

Tungsten carbide powder price is reported at RMB 690/kg, up 121.9% from the beginning of the year.

Cobalt powder price is reported at RMB 500/kg, up 194.1% from the beginning of the year.

70% ferrotungsten is reported at RMB 424,000/ton, up 97.2% from the beginning of the year.

European ferrotungsten is reported at USD 90-93.5/kg W (equivalent to RMB 448,000-466,000/ton), up 108.5% from the beginning of the year.

The price of scrap tungsten rods is reported at RMB 470/kg, up 113.6% from the beginning of the year.

The price of scrap tungsten drill bits is reported at RMB 437/kg, up 91.7% from the beginning of the year.

Prices of Tungsten Products on November 5, 2025

Tungsten Price Trend from January to November 5, 2025